1. Introduction

This document specifies the elements of a financial statement, the interrelationships between those elements, and the parts of a financial statement. Note that the FASB does not lay this information out as sustinctly or as completely. The purpose of this resourcse is to clear and complete.

SFAC 6 states explicitly that economic entities creating financial reports will define their report line items based on these financial statement elements.

"Particular economic things and events, such as cash on hand or selling merchandise, that may meet the definitions of elements are not elements as the term is used in this Statement. Rather, they are called items or other descriptive names. This Statement focuses on the broad classes and their characteristics instead of defining particular assets, liabilities, or other items."

***** NOTE ***** This version consciously leaves out details related to Net Assets in order to create a simple, incrementally complex prototype. The SFAC 8 prototype expands this prototype to add the complexity realated to Net Assets which includes multiple reporting styles.

When thinking about what this resource is trying to represent it is important to have the proper perspective. The focus of this resource is the high-level definitions of the element of financial statements, the relationships between those elements, and where the elements are organized within a disclosure within a financial statement. Measurement, recognition, materiality, conservatism, all occur with the framework of these elements of financial statements. Those principles are used to arrive at the numbers. Whatever the measurement, what has been recognized and what has not been recognized, what is material or what is not material, and such all occur before information goes into the statement. This resource is about the statement itself; not about how the numbers that go into the statement were arrived at. Think of the notion of 'layers' or 'levels'. [CSH: This explaination needs work.]

1.1 Elements

The following provides formal definitions of the high-level elements of a financial statement. These elements are formally defined by the Financial Accounting Standards Board (FASB) within SFAC 6 - Elements of Financial Statements [FASB CON6].

DEBIT

as of point in time

CREDIT

as of point in time

CREDIT

as of point in time

CREDIT

for period of time

DEBIT

for period of time

CREDIT

for period of time

CREDIT

for period of time

DEBIT

for period of time

CREDIT

for period of time

DEBIT

for period of time

1.2 Interrelationships

The following provides information about the formal interrelationships between the elements of a financial statement that are either formally defined by the Financial Accounting Standards Board (FASB) within SFAC 6 - Elements of Financial Statements [FASB CON6] or are implied and understood common practice.

1.3 Statements

The following provides information about the formal statements within a set of financial statement that are either formally defined by the Financial Accounting Standards Board (FASB) within SFAC 6 - Elements of Financial Statements [FASB CON6] or are implied and understood common practice.

1.4 Examples

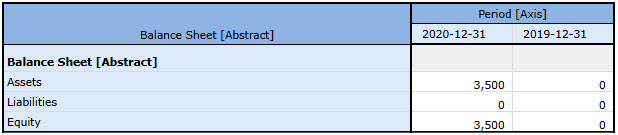

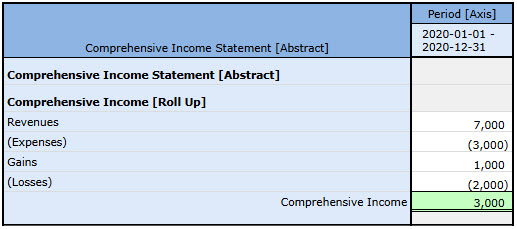

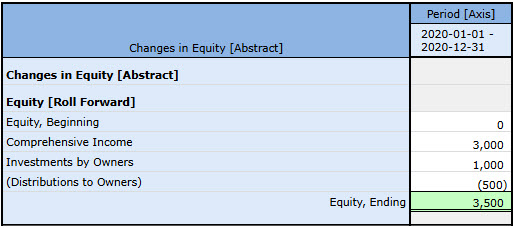

The following are examples of a set of financial statements using the elements of financial statements which conform to the interrelationships of the elements:

1.5 Transactions

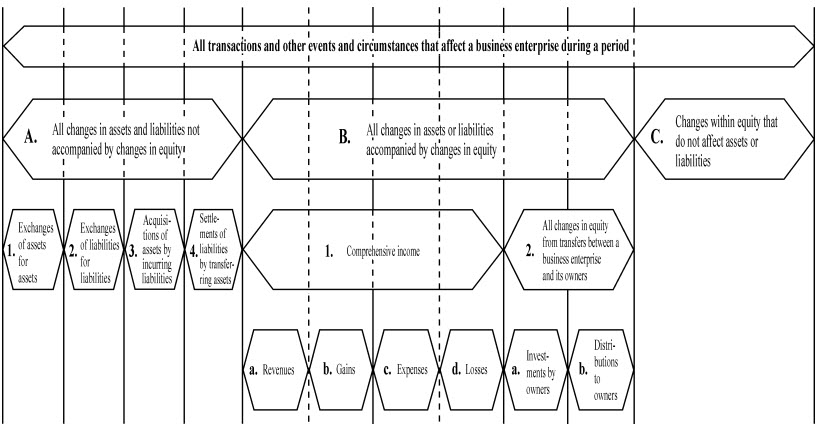

The following graphic shows the relationships between transactions, statements, and elements of financial statements:

1.6 Types

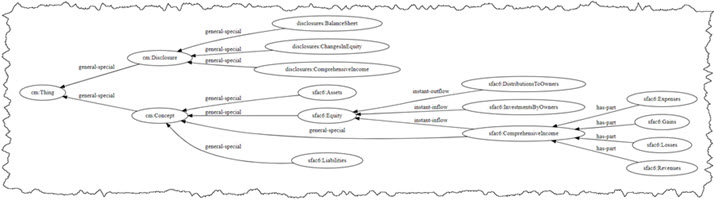

The following graphic shows types and subtypes (a.k.a. general-special assocations, wider-narrower associations) of the elements of financial statements:

1.7 References

The following is a summary of normative and informative references helpful in understanding this information:

1.7.1 Normative references

- [FASBCON6]

- Elements of Financial Statements. Financial Accounting Standards Board (FASB). 2004. URL: https://www.fasb.org/Page/document?pdf=aop_CON6.pdf&title=CON%206%20(AS%20AMENDED)

- [PROOF]

- PROOF. SFAC 6 PROOF. 2024. URL: https://auditchain.infura-ipfs.io/ipfs/QmdZhQeZg8PfU7Ce3ApkZTaJBK1FzzhkRrnVCoFg1jVBHv/

1.7.2 Informative references

- [SFAC6-MODEL]

- SFAC6 MODEL. Charles Hoffman, CPA. 03 June 2024. URL: http://xbrlsite.com/seattlemethod/platinum/sfac6/sfac6_ModelStructure.html

- [EXAMPLE]

- Example Financial Statement. Charles Hoffman, CPA. 03 June 2024. URL: https://xbrlsite.azurewebsites.net/2019/Core/core-sfac6/evidence-package/

- [DOCUMENTATION]

- Impediments to Creating Properly Functioning XBRL-based Reports (SFAC 6). Charles Hoffman, CPA. 03 June 2024. URL: Documentation.pdf